The Code of Economic Law (“het Wetboek van Economisch Recht” hereafter: WER) was recently complemented with a 19th book: book XIX “Debts of Consumers”. This book was introduced by the law of May 4, 2023[1] , published in the Belgian Official Gazette on May 23, 2023.

- Background

Up until recently, the way in which companies could pursue unpaid invoices from consumers was regulated by a law of December 20, 2002[2]. There was a relatively large contractual freedom.

Companies determined the period within which the consumer had to pay the invoice, which recovery costs were charged in case of non-payment and from when these costs were due. The consumer accepted these terms and conditions and was protected by consumer legislation.

Over the years, various bills have been proposed to make the law of December 20, 2002 more consumer-friendly. The objective of the legislative initiatives was always the same: to protect vulnerable consumers from the accumulation of their debt in case of non-payment by limiting the charging of interest, damages, collection costs etc.

Despite the criticism on these bills coming from companies, from the Council of State or from the Order of Flemish Bars etc., on May 4, 2023, the new law on amicable debt collection for consumers was published, which will undoubtedly have far-reaching consequences.

- Situation

The new law is located in Book XIX of the WER and consists of two parts:

- On the one hand, the law contains rules on what can and must be done in the event of a non-payment by a consumer (Title 1)

- On the other hand, the law contains rules on the (activity of) amicable debt collection of a consumer(Title 2)

In addition, there is also legislation on the recovery of consumer debts in:

- Book 5 of the New Civil Code (hereafter NBW): this contains general rules on the notice of default, damages clauses and interest and a general prohibition of abusive contract clauses;

- Book VI of the WER: which contains specific legislation on wrongful clauses in B2C contracts.

The new law applies as a general law and does not affect pre-existing specialised legislation. All legislation concerning this topic will be applied cumulatively. When there is a contradiction, the specialised legislation will apply. Consumers should therefore not be blinded by the rules in the new law as it is quite possible that for certain sectors (e.g. energy and water distribution) other rules may apply.

Since Book 5 of the NBW also contains general rules on this subject, it remains to be seen how the new law and the NBW will coexist in practice.

- Scope of application

The broad scope of application of the new law is one of the reasons why it will be so impactful. The new law applies to: ‘any late payment of a debt owed by a consumer to a company’.

- Personal scope

The new law applies between companies and consumers and thus “B2C.”

A consumer is thereby defined as: ‘any natural person acting for purposes outside his trade, business, craft or profession.‘

An enterprise is: ‘any natural or legal person who pursues an economic goal in a sustainable manner, as well as its associations’ and this regardless of the size of the company.

Thus, not only companies in the traditional sense of the word are covered by the new law, but also, for example, hospitals and liberal professionals.

- Material scope

Just about any type of debt owed by a consumer will fall under the new law.

The new law applies to any late payment, so it is not only for invoices that remain unpaid. Both contractual (e.g. purchase of a new kitchen or piece of furniture, invoice from a contractor or gardener) and legal (e.g. unpaid parking fees) debts will from now on have to be collected taking into account the rules of the new law.

- Temporal scope

A distinction must be made based on when the contract from which the debt arises was concluded:

- Contract concluded before September 1, 2023: the new law comes into force on December 1, 2023

- Contract concluded after September 1, 2023: the new law applies immediately

- Consequences in case of non-payment by a consumer

- Late payment B2C

The new law primarily regulates what a creditor must do when a consumer fails to pay (on time).

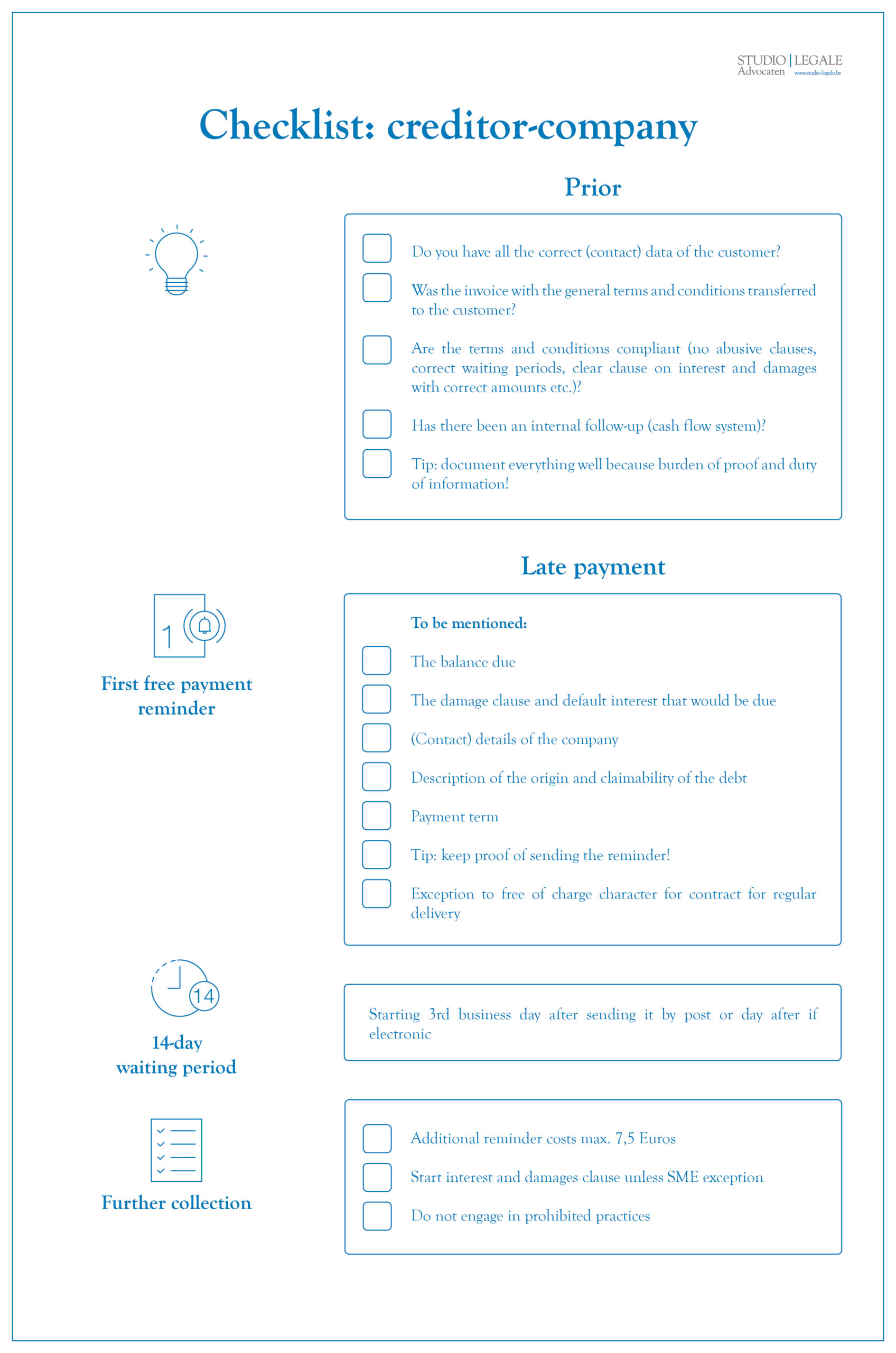

If the consumer has not paid by the agreed due date, the company must first send a mandatory free payment reminder. The reminder may be sent by mail or electronically.

After the first reminder, the consumer must be given another 14-day payment period. This 14-day period starts on the 3rd business day after the reminder is sent, or the day after if the reminder is sent electronically.

The first reminder must also contain some mandatory information:

- The balance due;

- The damages clause that would be due;

- Details of the company;

- Description of how the debt arose and became due; and

- The period of payment.

Basically, it comes down to the fact that the consumer needs to know what debt is involved so that he can adequately respond to it (pay/contest).

An exception to the free of charge nature of the reminder exists in the case of contracts for regular delivery of goods and services. Such creditors must send free reminders for non-payment for three due dates per year. As of the fourth late payment in a year, the creditor may charge reminder fees. The law stipulates that additional reminder costs cannot exceed 7,5 Euros plus postage.

The burden of proof that the free reminder was sent and that the 14-day deadline was respected lies with the company. The company does however not have to prove that the reminder was actually received, though this is the case for the invoice itself.

Contract clauses deviating from the above formal requirements are prohibited and null and void (read: deemed non-existent).

The company may only charge penalty clauses and interest on arrears when this is provided for in advance in the (contract) conditions and only after expiry of the additional 14-day payment period.

With regard to the latter, an exception has been provided for SMEs[3]: if the company is an SME, it may stipulate that interest already begins to run the day after the first payment reminder is sent.

Moreover, the maximum damages and interest a company may charge is capped:

- Interest: no more than the reference interest rate[4] from art. 5 § 2 of the law of 2 August 2002 on late payment in commercial transactions (currently 3.75%) plus 8% and this on the amount still to be paid.

- Damages:

- 20 Euros if the balance due is less than or equal to 150 Euros;

- 30 Euros plus 10% of the amount due on the tranche between 150.01 and 500 Euros if the balance due is between 150.01 and 500 Euro;

- 65 Euros plus 5% of the amount due on the tranche above 500.01 Euros with a maximum of 2,000 Euros if the balance due is above 500 Euros.

Apart from interest and/or damages and within the aforementioned limits, no other costs may be claimed from the consumer.

The person collecting the debt for a company may therefore not charge the consumer any additional costs for his interference.

Clauses providing amounts that do not correspond to the aforementioned limits are prohibited and null and void. In such a case, no damages or interest can be awarded, as the clause that provided for this no longer legally exists.

Here, it is important to refer to art. XI.83 17° and 24° WER[5]. These articles provide that in B2C relations, damages clauses that are clearly disproportionate (read: in proportion to the disadvantage suffered by the company) and not reciprocal (read: for both the company and the consumer) are illegal. Therefore, for the damage clause to be valid, not only the aforementioned maximum amounts must be taken into account, but also the proportionality and reciprocity of the clause.

Finally, the creditor-company has been given a special duty to inform the consumer. At the consumer’s request, the company must immediately provide, on a durable medium (read: paper/electronic), all documents relating to the debt, as well as information on how it can be disputed.

- Activity of amicable debt recovery

Secondly, the new law regulates the modalities of when the debt is recovered by a professional for the creditor-company.

- Meaning of “activity of amicable debt collection”

The term “amicable debt collection” is broadly defined in the WER as: “any act or practice of a company aimed at inducing the consumer to pay an unpaid debt, excluding any recovery pursuant to an enforceable title”.

The term can therefore range from sending reminders, emails or text messages, to making phone calls, conducting home visits, sending messages via social media etc.

Until recently, the activity of amicable debt collection was regulated by the law of December 20, 2002. These regulations are now included in Title 2 of the new law.

Title 2 applies to anyone who amicably collects a debt from a consumer. It makes no difference whether the debt is collected by someone who does this professionally (collection agency, lawyer, bailiff etc.) or by the creditor himself. When the recovery is done professionally, we speak of “activity of amicable debt collection”.

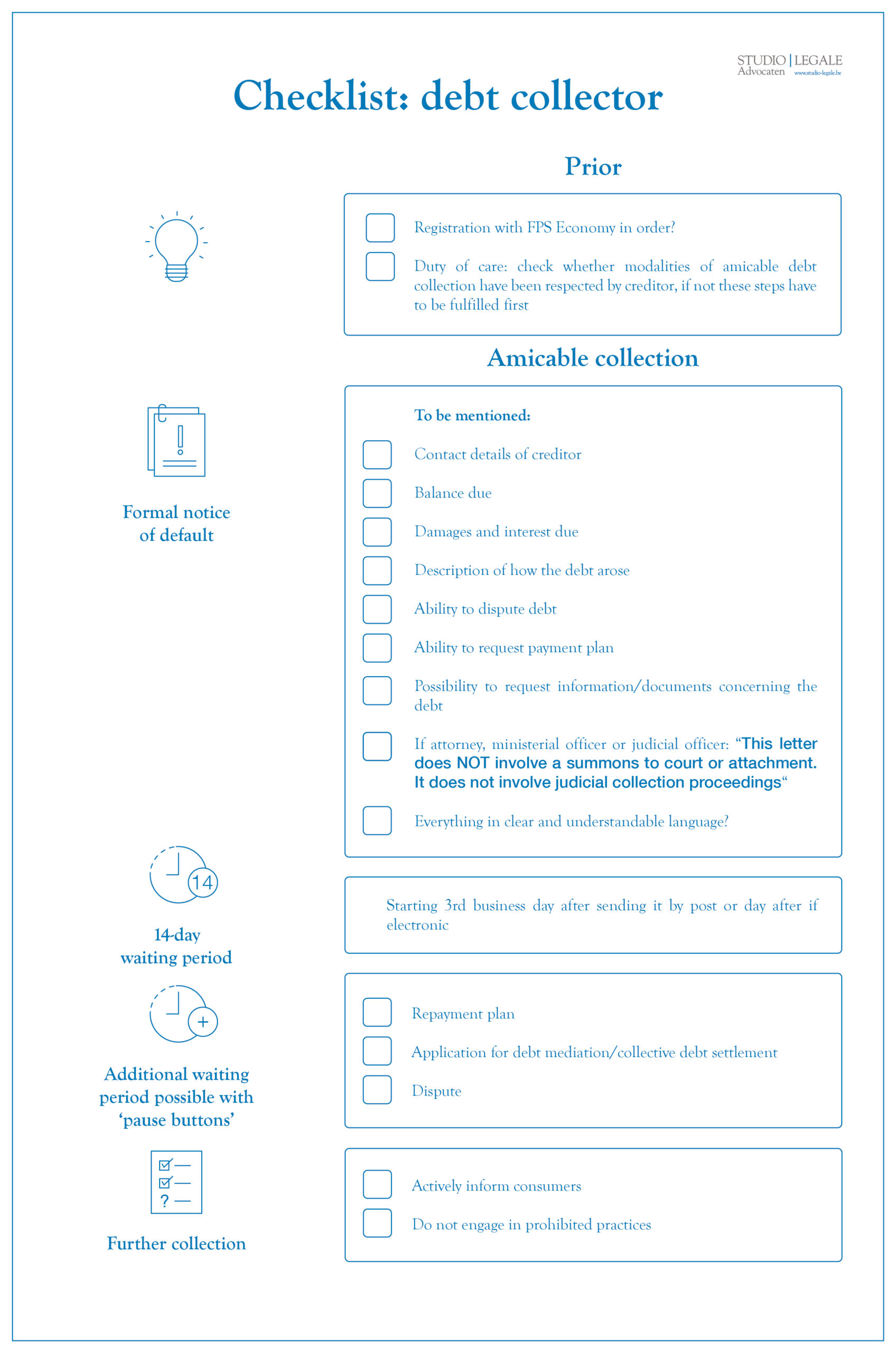

- Obligations for the activity of amicable debt collection

Anyone who engages in an activity of amicable debt collection must first register with the FPS Finance and is also inspected by that authority. The new law provides an exception to registration for lawyers, ministerial officials or judicial mandataries in the exercise of their functions.

The registration conditions and guarantees that persons must have in order to be registered are laid down in a Royal Decree of February 17, 2005. The application for registration is made electronically and must include a number of documents and information (see articles 2, 3 and 4 of the aforementioned Royal Decree). The persons accepted and registered by the FPS Economy appear on a list published by the FPS Economy on its website.

- Modalities of exercising the activity of amicable debt collection

In order to protect consumers, the law of December 20, 2002 already provided for a number of practices that were prohibited in the amicable collection of a debt. These were generally practices that could harm the consumer’s private life or human dignity.

These prohibited practices were not fully adopted in the new law, as they are already included in the WER, namely in Book VI (art. VI.92 WER – VI.103 WER).

Nevertheless, the new law still repeats some specific prohibited practices, such as:

- XIX.5 WER: prohibition of recovery from a person who is not the debtor;

- XIX.10 §3 and 11 § 2 WER: no telephone calls or home visits between 10 pm and 8 am.

In addition, any amicable collection of a debt must still start with a written notice of default, which must contain a number of mandatory information.

After sending the formal notice, no other action may be taken toward the consumer before the expiration of a 14-calendar-day waiting period. This waiting period begins on the 3rd business day after the reminder is sent, or the day after if the reminder is sent electronically.

Amicable collection should be paused if the consumer responds to the formal notice in one of the following ways:

- The consumer requests an installment plan: in this case, no further recovery steps may be taken until a decision on the installment plan has been made and this decision must be made no later than 30 calendar days after the request. This time limit starts on the first business day after the request. If the deadline is exceeded, default interest will be suspended until a decision has been made.

- The consumer applies for debt mediation or collective debt settlement: in this case, no further steps may be taken until a decision has been taken on the application. If this decision is not made within 45 calendar days of the application, amicable recovery may be resumed. In a debt mediation, the 45-calendar-day period begins on the first working day after the application was submitted. In the case of a collective debt settlement, the period begins from the day the petition was filed.

- The consumer may dispute the debt: in this case, no further steps may be taken until a decision on the dispute has been made and this decision must be made no later than 30 calendar days after the dispute. This deadline starts on the first working day after the dispute. If the time limit is exceeded, the interest on the delay is suspended until a decision is made.

Finally, the debt collector may not demand any additional costs from the consumer as compensation for his intervention. The debt collector must be compensated by only the creditor.

- Duties of the “debt collector”

It is notable that the new law imposes a far-reaching duty of care on the debt collector. The debt collector is given the task of verifying that all modalities of amicable debt collection are respected.

Thus, the debt collector will first have to verify whether the creditor has already sent a first free payment reminder and whether the amounts of damages and interest claimed from the consumer therein are within the legal maximums.

If not, the debt collector must first send a free payment reminder, containing the correct amounts, and then respect 14 calendar days’ waiting period. Only then may the first formal notice be sent.

The debt collector must also ensure that the formal notice has been drafted clearly and comprehensibly and contains all mandatory information. At a minimum, the formal notice must provide information on how the debt can be contested, that payment facilities can be requested, and that the consumer can request all supporting documents related to the debt. In addition, general information about the origin of the debt, the original creditor (if any), contact details of the (current) creditor etc. should also be included. In addition, if the debt collector is a lawyer, ministerial official or judicial officer, the following sentence should be included in a separate paragraph and in a different font in bold:

“This letter does NOT concern a summons to court or attachment. It does not involve proceedings of judicial recovery.”

The duty of care is very far-reaching, especially since non-compliance is sanctioned with criminal sanctions and the burden of proof of compliance is placed on the debt collector himself.

In addition to a duty of care, the debt collector is also given an active duty of information about the status of the debt. For example, the consumer paying off the debt must receive a statement of his repayments once a year. When the consumer has fully repaid the debt, he must be informed immediately.

- Sanctions

Non-compliance with the aforementioned imposed rules can, since the new law, have very far-reaching consequences, now that concrete sanctions are linked to it. Sanctions can take place at different levels.

- Civil law sanctions[6]

If, during the amicable debt collection process, the consumer has paid amounts wrongfully – read: in violation of the new law – then, from a civil point of view, it is perceived as an undue payment obtained in bad faith. In such a case, the court can order that the person who received this payment is obliged to repay this amount.

In addition, if the obligations regarding the free initial payment reminder are not complied with, the consumer is automatically exempted from paying the damages clause.

- Criminal sanctions[7]

If the first free payment reminder, the information obligation or the upper limit of the damage clause is not complied with, a level 2 criminal sanction may be imposed for this.

This includes:

- a criminal fine of 26,00 Euros to 10,000.00 (x 8) Euros or;

- a fine of up to 4% of the total annual turnover in the last completed fiscal year, whichever is higher in the case of violations of general rules.

A breach of the debt collector’s duty of care, the mandatory notice of default the debt collector’s compliance with deadlines and the debt collector’s obligation to provide information may result in a level 4 criminal penalty.

This includes:

- a criminal fine of 26,00 Euros to 10,000.00 (x 8) Euros or;

- up to 6% of the total annual turnover in the last closed financial year if it represents a higher amount in case of violation of general rules.

Clearly, it will be of great importance for a debt collector to properly comply with the rules, as the financial impact of a fine can be large. Now that the burden of proof of compliance rests with the debt collector, it is also important to properly document each step taken so that one has a strong file and can challenge the fine if necessary.

- Administrative supervision[8]

There is also administrative supervision of compliance with regulations regarding amicable debt collection, now that FPS Economy officials are empowered to detect and determine violations of Book XIX WER.

The officials of the FPS Economy will check on a regular basis whether the debt collector still meets the registration conditions granted to him. They may request additional information and documents from the debt collector at any time.

- Considerations

Over the years, draft laws on the amicable debt collection for consumers have become more and more far-reaching. Finally, a law has emerged that will certainly have a major impact on the relationship between the company and the consumer and which severely restricts the freedom of contract between those parties.

Now that penalties are also attached to compliance with the obligations and the burden of proof of compliance lies with the company, the creditor/debt collector bears a very large responsibility within the amicable debt collection process. This while there is actually a responsibility on the consumer/debtor to pay.

The new law only applies to amicable debt collection. It could be that creditors will now move more quickly to the judicial recovery process and summon the consumer immediately, which obviously does not benefit them either.

In addition, late payment in commercial transactions (B2B) is regulated by the law of August 2, 2002. Consequently, the new law will not apply here. It is noteworthy that the legislator just recently imposed shorter payment terms between companies in order to reduce the negative consequences of late payment on companies. The parliamentary preparations for the Amending Act stated: “The consequence of these late payments is that our SMEs, faced with a lack of liquidity, postpone payments themselves, ultimately creating a ‘chain of postponement’, which affects the entire economy (…) In this way, investments are postponed, the hiring of personnel is delayed, in other words, the creation of added value is postponed.”

Consumers will have more time to pay thanks to the new law. This could have the effect of compromising the smooth flow of payments for and by companies.

The legislator is clearly struggling with the question of who needs the most protection: the business or the consumer. With the consumer still considered the economically weaker and a less experienced party in legal matters, the consumer seems to be the one who will ultimately prevail.

Next, the impact of the new law on the cash flow of businesses should not be underestimated. The new law provides opportunities for the consumer to “delay” making payment, this without allowing the debt collector to do anything, which gives the consumer little incentive to pay. The longer a company has to wait for payment, the greater the likelihood of liquidity problems. As a result, a company may have to postpone payments or investments itself, which obviously does not benefit the economy. Although a small exception is provided for SMEs as to when interest and damages may be charged, the impact of this in relation to the period during which they may have to wait for payment seems limited.

Finally, the question arises as to whether the purpose of the new law (i.e., to protect financially vulnerable consumers) is achieved merely by giving consumers more time to pay. The ability to delay a payment longer does not necessarily benefit a financially vulnerable consumer. It allows him to put off the problem and may give the perception that there is still room to make other purchases, which will only increase the amount of debts.

Whether or not these considerations are justified will remain to be seen in the future.

The law is already being applied, making it important for companies to check whether their general terms and conditions and internal operation in the event of debt collection are compliant.

If you have any questions about this or would like advice, do not hesitate to consult Studio Legale Lawyers on 03 216 70 70 or [email protected].

[1] Hereafter: the new law

[2] https://etaamb.openjustice.be/nl/wet-van-20-december-2002_n2002011523.html

[3] As defined in Art. 1:24 paragraph 1 of the WER

[4] Being the interest rate used by the European Central Bank for main refinancing operations.

[5] Book VI of the WER, as already indicated, still contains specific legislation on abusive terms in the B2C relationship.

[6] Art. XIX 14 WER en art. XIX 15 WER

[7] Art. XV.125/2/1 WER

[8] Art. XV.66/5 WER